- Copay Coinsurance Deductible

- Copay Coinsurance Deductible Definition

- Copay Coinsurance And Deductible

- What Does Coinsurance Mean

Coinsurance is a portion of the medical cost you pay after your deductible has been met. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. For example, if your coinsurance is 20 percent, you. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators.

Copay or Co-payment refers to a fixed amount of money you need to pay for certain types of treatment when the rest balance amount will be paid to the insurer. The can be a pre-decided amount or a percentage of the total cost of treatment depending on the policy you choose. Coinsurance The percentage of costs of a covered health care service you pay (20%, for example) after you've paid your deductible. Let's say your health insurance plan's allowed amount for an office visit is $100 and your coinsurance is 20%. If you've paid your deductible: You pay 20% of $100, or $20.

There are a number of words and terms related to the way Medicare works, and one of the most important ones to know is coinsurance.

What is Medicare coinsurance?

Coinsurance is the percentage of a medical bill that you (the Medicare beneficiary) may be responsible for paying after reaching your deductible. Coinsurance is a form of cost-sharing; it's a way for the cost of care to be split between you and your provider.

The deductible is the amount you are required to pay in a given year or benefit period before Medicare begins paying its share.

How does Medicare coinsurance work?

Let’s use an example to explain it more clearly.

John has Original Medicare (Part A and Part B) and goes to the doctor for outpatient treatment.

John’s doctor appointment is covered by Medicare Part B, and his doctor bills Medicare for $300. Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year.

After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost.

Medicare Part B requires beneficiaries to pay a 20 percent coinsurance payment after reaching their deductible. This means that John will pay 20 percent of the remaining $97 of his bill, and Medicare Part B will cover 80 percent.

The total amount that John will have to pay for his appointment is $222.40, broken down as follows:

| Total medical bill | $300 |

| 2021 Part B deductible | $203 |

| 20 percent Part B coinsurance of remaining $97 | $19.40 |

| Total beneficiary will pay | $222.40 |

Copay Coinsurance Deductible

How much is Medicare coinsurance?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B.

So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.

| The Medicare-approved amount is a predetermined amount of money that Medicare has agreed to pay for a covered service or item. |

Private Medicare plans, such as Medicare Advantage and Medicare Part D Prescription Drug Plans (PDP), may feature coinsurance of their own.

While 20 percent is the typical coinsurance amount for Medicare Advantage plans, some plans may feature a 70-30 or 90-10 split.

Medicare Prescription Drug Plans may feature coinsurance or copay amounts that vary depending on the type of drug and what tier that drug is in, according to your Medicare drug plan formulary.

Why does Medicare charge coinsurance?

Cost-sharing measures such as coinsurance (and copays, which you can read more about below) are a way to help keep beneficiaries accountable for their care costs.

With no coinsurance in place, a patient could potentially visit a doctor more frequently for unnecessary health care services after they meet their deductible, because they would pay nothing out-of-pocket for the services.

This would leave the insurance plan carrier to cover all costs of such unnecessary care, which would drive up plan costs for other beneficiaries and contribute to overburdening the health care system.

Cost-sharing is one way of helping ensure that patients are more selective about the type of care they seek.

Coinsurance vs. copays

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing. A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee.

For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases. But Medicare Part A uses copayments for hospital stays, which begin at $371 per day for days 61-90 of an inpatient hospital stay in 2021.

The primary difference between coinsurance vs. copays is that copayments are a flat fee amount instead of a percentage.

Get coverage for Medicare coinsurance

One way you can get some coverage for Medicare coinsurance is by purchasing Medicare Supplement Insurance.

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs, such as coinsurance, copayments and deductibles.

In exchange for paying a monthly premium to belong to the plan, a Medigap plan can help cover the cost of your Medicare coinsurance and/or your deductibles.

If John from our above example had a Medigap plan that covered his Part B deductible and coinsurance, he may have owed nothing for his doctor’s appointment.

Medicare Advantage plans typically include coinsurance

Many Medicare beneficiaries choose to get their benefits through a privately-sold Medicare Advantage plan (Medicare Part C), which provides the benefits of Original Medicare combined into one plan.

Many Medicare Advantage plans may also offer prescription drug coverage, as well as coverage for hearing, dental and vision care, which are not typically covered by Original Medicare.

While a Medicare Advantage plan will likely include coinsurance costs, a plan could help you save on some of your other out-of-pocket health care costs, which could help offset some of your coinsurance payments. Helio x10.

To learn more about Medicare Advantage and to compare the plan options available in your area, call to speak with a licensed insurance agent today.

Explore Medicare Advantage plan benefits in your area

Or call 1-800-557-60591-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Health insurance is a contract between you and your insurance company.

Employer-provided health insurance is everyone’s dream.

Health insurance helps pay for health care. It helps cover services ranging from doctor visits to major medical expenses related to illness or injury.

Health insurance is a means for financing a person’s healthcare expenses. The majority of people have health insurance through an employer.

There are many different factors that need to be considered when looking at health insurance cost. What are your family’s healthcare needs and what can you afford?

Cheap health insurance usually means for people the lowest monthly premium. The lowest cost plans are also the skimpiest plans.

Individual health insurance is insurance you buy on your own not through an employer or association.

Rising healthcare costs and the desire to maintain profits is driving insurers and employers to shift more and more of the burden to policyholders through higher premiums, de

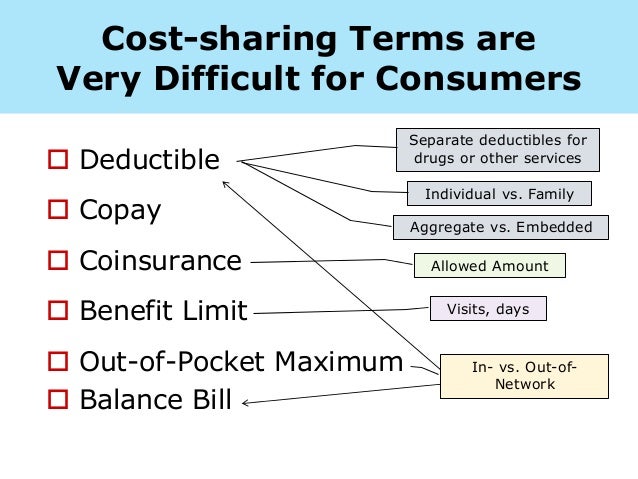

Cost sharing refers to the share of costs that you have to pay out of your pocket for health care services your insurance approves.

The terms in-network and out-of-network appear in all health insurance plans.

The deductible is the amount you have to pay first, before your health insurance plan pays.

Out-of-pocket maximum (OOPM) is the most you have to pay for covered medical services in a plan year.

An Explanation of Benefits (EOB) is a statement your health insurance company sends you showing how much was billed, how much they paid and how much you are expected to pay.

Think your health insurance will protected you from surprises? Think again.

Everyone wants to stay healthy. But sometimes we need a hand.

Depending on the type of health insurance you buy, your care may be covered only when you see a network provider.

Managed care plans are a type of health insurance. These plans focus on managing the care of members.

Grandfathered health insurance plans are those that were in existence before the Affordable Care Act was signed into law on March 23, 2010 and have stayed basically the same.

Copay Coinsurance Deductible Definition

A Consumer-Driven Health Plan (CDHP) is supposed to encourage employees to make informed decisions and spend healthcare dollars wisely.

Catastrophic health insurance plans come with considerable risk. You should give them a lot of thought before deciding.

Short-term health insurance plans were intended for people who experienced a temporary gap in health coverage.

Health Savings Accounts (HSAs) are accounts individuals can use to set aside money to help cover medical expenses associated with High Deductible Health Plans.

The COVID-19 pandemic has shut down most employers’ efforts to experiment with ICHRAs as a new type of benefit plan.

A Flexible Spending Account is a special account setup by your employer to be used to pay for out-of-pocket healthcare costs.

COBRA guarantees employees and their families the right to keep their group health insurance coverage when they would otherwise lose it after leaving their job.

A prior authorization is an acknowledgement by your health insurance company that a health care service is necessary before you receive the actual service.

Copay Coinsurance And Deductible

If your health insurer refuses to cover a procedure, pay a claim or ends your coverage you have the right to ask them to reconsider their decision.

An external review is an appeal of a health insurer's decision to deny coverage for or payment of a service.

If your Medicare Advantage plan denies you payment or medical services, don’t take it lying down.

What Does Coinsurance Mean

Donut Hole refers to a prescription coverage gap found in Medicare (Part D) drug plans.